Thoughts From The Divide – Slowing the Behemoth

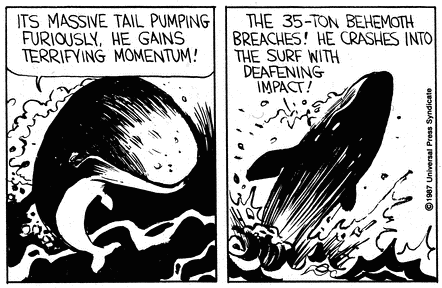

This week we highlight some amusing and bemusing dynamics observed in various sectors of the economy. Commercial real estate increasingly justifies the dumpster fire metaphor as it begins to dawn on both banks and market participants that there is more pain to come. Residential real estate, while remaining relatively robust, is showing some cracks in the façade as investors choose to sit this one out for now. And even manufacturing, which we consider one of our better “frogs”, is flashing warning signs, with the latest ISM Manufacturing data breaking below 47 as the survey’s New Orders Index continued lower. However, while these may be useful indicators or give us a sense of what is to come, they pale in comparison to the true behemoth of the US economy: the American consumer.

“Consumer price inflation was much higher than producer inflation”

This is clear in much of the commentary around inflation, where a “wage-price spiral” implies that consumers’ spending ability allows for the worrisome escalation. It is also implied in “greedflation” or the price-price spiral mentioned by Claudia Sahm and others, where they bemoan “the ability of firms with market power to hike prices” while casually glossing over the other side of the transaction, where, implicitly, someone was able to pay those higher prices. We don’t fault the commentariat for the lack of a definitive answer; after all, it is considered gauche to point out, as Dudley did, that stimulus and the various monetary injections might not have been without downside. “The interaction between the bargaining power of firms and a crisis like the pandemic presents an opportunity to raise prices aggressively”? Sure, but only if the buyers have the cash to pay those new prices.

“[Customers’ budgets] clearly are under pressure, and particularly in… discretionary categories”

Consumer confidence hasn’t been the tell, as spending and activity have continued well past the point that various metrics began souring last year (see here and here). But are things starting to change? The first indication lies in the latest earnings reports. While companies had previously been able to boost revenues by raising prices at the expense of marginally declining volumes (see P&G, for instance), recent earnings calls have warned of sales revenue declines, and consumers may be becoming more price sensitive, opting for cheaper brands or substitutes. The second thing we are watching is the labor market, which is usually (in the absence of stimmy) the consumers’ main source of incremental income. The labor market is showing signs of slowing. As the fed noted in the latest Beige Book, “many contacts said they were fully staffed, and some reported they were pausing hiring or reducing headcounts due to weaker actual or prospective demand or to greater uncertainty about the economic outlook”. Further, the latest BLS report, while showing that unit labor costs “increased 3.8 percent over the last four quarters”, did have a small nugget on compensation buried in the revision notes, “Hourly compensation… was revised from the previously reported increase of 4.9 percent to a decrease of 0.7 percent, due entirely to a downward revision to compensation”. Those feeling the compensation drop (should the data now reflect the “truth”) will likely have already responded (perhaps reflected in the price sensitivity mentioned above), while those viewing the data from a distance will be in danger of feeling some pain à la Twain’s warning we discussed last week. Is this perhaps the reason that LinkedIn recently saw a slight increase in the hiring rate? Why ADP’s payrolls number beat expectations? Why Credit card debt has ballooned and (or perhaps because) delinquencies are on the rise? With inflation on a downward trajectory, these data might be part of why the Fed has recently shifted to talking about “skipping” a hike at the next meeting. Businesses are unlikely to celebrate a drop in demand (as they may also be feeling a wee bit of a credit crunch), but the slowing consumer and its concomitant effects on inflation will likely be welcomed by the Fed. To those at the Eccles building, if slowing the consumer is your goal, be careful what you wish for because some behemoths need to keep moving to survive.

P.S. Dudley: “Better to risk a deep economic recession than out-of-control inflation