Thoughts From The Divide - Adjusting Expectations + Registration Open for Global Macro Summit!

We at MI2 often find ourselves quoting Mark Twain (see here, here and here). In our collective experience, his “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so” is truly evergreen and may be particularly apt at this moment in time.

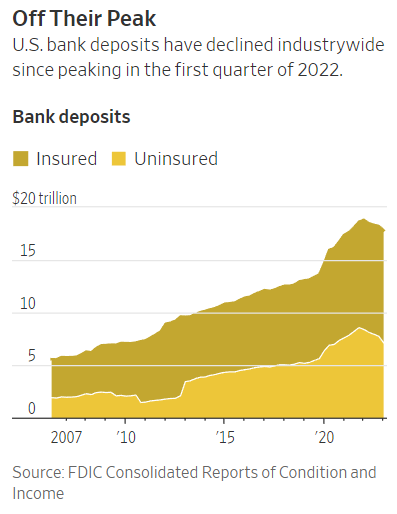

“Declining deposits and runs on banks raise questions about whether most deposit amounts are sustainable”

In the banking world, both Twain and the saying about what happens when one assumes appear to apply, as the WSJ notes in “Bank Runs Trash Long-Held Assumption on Deposits”. As the article explains, “the recent spate of bank failures is upending a long-held theory among banking executives and regulators—that the value of a lender’s deposit business goes up when interest rates move higher”. The theory assumed that “deposits would be a stable source of low-cost funding while the bank earned more money lending at higher rates” (Emphasis our own). It turns out that you really can’t fool all of the people all of the time (an aphorism often incorrectly attributed to Abraham Lincoln) when it comes to money, as has been highlighted by various headlines on the shift to money market funds and by the Fed itself in a recent paper on deposit beta (“… banks are facing significant competition for savers from other vehicles that offer rates closer to the fed funds rate, such as money market mutual funds.“) Funny how the theory cited in the WSJ article rested on the idea that depositors wouldn’t vote with their feet as they looked around and saw short term treasuries offering a not-so-subtle 10x the yield of their “savings” accounts.

“Interest rate increases… crushed the business model that [investors]… hoped would make them wealthy”

Banks are not the only place where long-held assumptions are being upended. Real Estate, our current favorite economic “indicator species”, is also seeing a fair share of expectation adjustments. On the residential side, as this WSJ notes, while real estate syndicators may have once argued that “Even if [the] economy goes down, still I make money”, they are changing their tune with one going as far as to “suggest that you contact your tax advisor to discuss how your investment loss can be recognized on your tax filings”. The slimmest of silver linings. The article explains that, courtesy of higher rates, rising property taxes and insurance costs, and increasing tenant delinquencies, syndicators are facing a bleak reality: “Many syndicators are racing to either raise funds or sell properties before tipping into foreclosure. Most hold balloon-payment loans that require repayment when they come due this year or next. Those syndicators face large payouts at a time when getting new, more affordable property loans will be difficult. Even firms with multibillion-dollar portfolios have used syndication to buy apartment buildings that no longer make enough money to cover debt payments, bond documents show.” To add to all the irony, Sam Zell (RIP “grave-dancer”) has shuffled off this mortal coil, just as the market was turning into his favorite kind of playground. That guy really knew his market.

P.S. An executive at J.B. Hunt told investors that he didn’t “have any green shoots” to report in the transportation market and that “everybody has a significant dose of ‘I have no idea’”.

In case you missed our announcement, registration is officially open for our Global Macro Summit from Sept 26th - 29th in Vail, CO!

This will be the first macro event of its kind, designed to refine, challenge, and inform your investment strategies.

We already have an amazing line up of speakers including some of the best macro minds and risk-takers out there who we look to to guide MI2's decision making. You'll have the chance to explore and dissect specific themes and trends in panel discussions and intimate breakout sessions with these sought after experts.

You'll also be able to spend time in the beautiful Vail Valley during one of its most stunning seasons and choose from a variety of local excursions to experience with speakers. Or bring a plus one to enjoy together!

You don't want to miss out on what will be the macro event of the year. Save $500 on a General Admission ticket for a LIMITED TIME ONLY.