Thoughts From The Divide – Powell Counterpoints

“Time will tell”

Today, at the Jackson Hole conference, Jerome Powell gave a speech on “Monetary Policy in the Time of COVID”. In addition to his evaluation of the employment outlook, Powell offered his assessment on “the path ahead” for inflation, citing five different “factors” as reasons to believe that the “elevated readings are likely to prove temporary”. Unfortunately for Powell, recent data, including some from the Fed itself, offer a rejoinder for each of his points.

1.“Absence so far of broad-based inflation pressures”

Powell explains that while there have been moves in energy and hard-hit services such as “hotel rooms and airplane tickets”, these moves have been transitory and a function of base effects. While it’s true that base effects may no longer be quite as strong of a tailwind, the Fed’s own Underlying Inflation Gauge, which measures inflation “from information contained in a broad set of price, real activity, and financial data”(emphasis our own), remains at its highs. Likewise, prices continue to increase for ubiquitous materials such as semiconductors and steel (see below).

2.“Moderating inflation in higher-inflation items”

The rate of increase in the price of used cars has indeed cooled, and durables have lost some of their luster, as we highlighted here, but cost pressures continue. Toyota is increasing the price of steel for its suppliers. TSMC made headlines with its price hikes. And the latest Kansas City and Richmond Fed manufacturing surveys followed in the Empire and Philly Feds’ footsteps in reporting the highest prices received on record. What’s more, even if there is some relief and prices come off, a positive inflationary impulse from housing may take up some of the slack, as Fannie Mae explained here, and Larry Summers warns in his recent op-ed on the dangers of continued QE.

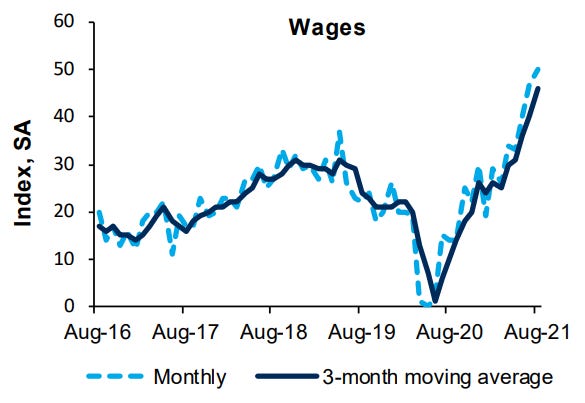

3.“Wages”

While the FOMC currently sees “little evidence of wage increases that might threaten excessive inflation”, the Richmond Fed’s wages metric hit an all-time high in its latest report. Admittedly, if the latest University of Michigan consumer sentiment results are any indication, consumers don’t expect their own wages to move up in a “wage-price spiral” and were somewhat dour as “personal financial prospects continued to worsen due to smaller income gains amid higher inflationary trends”.

4.“Longer-term inflation expectations”

While Powell sees inflation expectations are “now at levels more consistent with our 2 percent objective”, the gloomy sentiment of the consumers mentioned above are partly a product of their inflation outlook. Consumers’ expectations of one-year and five-year price changes are either hitting or tying the highest levels since 2008, at 6.1% and 3.9%, respectively.

5.“The prevalence of global disinflationary forces over the past quarter century”

Finally, Powell pointed to globalization, technology, and demographics as “sustained disinflationary forces”. The technology and demographics discussions aside (we have addressed them here, here, and here), while globalization may be deflationary in the long term, the disruptions in supply chains, from temporary port closures to driver shortages, will likely at least negate these benefits if not contribute to rising costs. The rise in container shipping rates from China to LA is a good example that recently made headlines.

All in all, as Powell put in his speech, though “the Delta variant presents a near term risk”, while “we have much ground to cover to reach maximum employment…. time will tell whether we have reached 2 percent inflation on a sustainable basis”. Time will tell, indeed.