Thoughts From The Divide – Heady Inflation and Consumer Response

“Neither easy nor smooth”

This week’s Headline CPI print was 5%, the “highest since the summer of 2008” and Core CPI was 3.8%, “the sharpest increase in nearly three decades”. Breaking it down into the subcomponents, CNBC noted that “prices surged across a variety of sectors”. Unsurprisingly, one of the more impressive moves was the 7.3% month-on-month and 29.7% year-on-year increase in the price of used cars and trucks. “Household furnishings and operations rose 1.3%, the biggest month-over-month gain since January 1976”. And even sometimes-perplexing shelter costs joined in, rising “0.3% for the month and 2.2% year over year”. An article from UC Berkeley offers some perspective on this data. “While the price increases are sobering, the Berkeley economists expect inflation arising from the pandemic to be temporary” arguing that bottlenecks will eventually ease and that the “economy will return to a more natural balance”. Markets appear to be in agreement and “largely shrugged off” the inflation report. This may partly reflect bonds having already “priced in” these prints (though forecasters may not have) or perhaps the jobless claims put a damper on the enthusiasm, with initial claims coming in at the lowest level since March 14, 2020, but higher than expectations.

“Unfavorable perceptions”

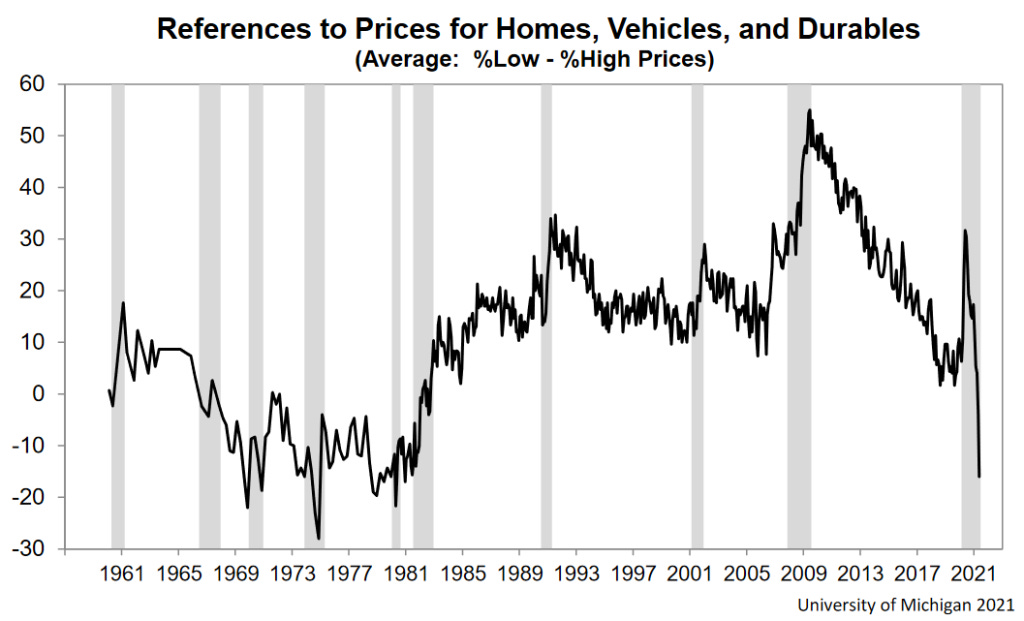

While the bond market may seem nonplussed by the inflation the latest survey data reveals that consumers have not only noticed but are also adjusting their buying attitudes. The latest University of Michigan Survey of Consumers noted that “in the emergence from the pandemic, consumers are temporarily less sensitive to prices due to pent-up demand and record savings as well as improved job and income prospects.” These latter beliefs were evidenced by the survey finding “an all-time record number of consumers anticipating a net decline in unemployment”. However, consumers may soon reach the limit of their reduced price sensitivity. “Rising inflation remained a top concern of consumers” and “Spontaneous references to market prices for homes, vehicles, and household durables fell to their worst level since the all time record in November 1974”. The UMich survey’s commentary concludes with the comment that while “a shift in the Fed’s policy language could douse any incipient inflationary psychology, it would be no surprise to consumers, as two-thirds already expect higher interest rates in the year ahead”.