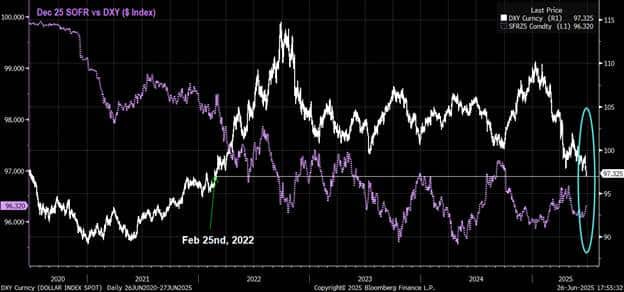

Last week’s TFTD “Trump twists, Powell sticks”, we noted that “even in the contest between Fed Chair and POTUS, the issue is not certain,” and that “it’s not much fun being a lame duck”. It seems that financial journalists have finally caught up with the story, attributing the recent dollar weakness to Trump’s threat to turn Powell into a lame duck. Consider us skeptical. Dec SOFR contracts have perked up by about 30bps from recent lows, but does that really explain the most recent bout of dollar weakness? The last time DXY traded down here (97.325) was Feb 25th 2022.

Still, we can all see the direction of travel, and there are plenty of other reasons to be bearish the dollar, so maybe this was just the final straw. Either way, whoever placed this “exclusive” with the WSJ didn’t feel the need for subtlety. Warsh, Hassett and Bessent were all suggested as possible Powell replacements. Oddly, given his and Michelle Bowman’s efforts to push the FOMC towards earlier cuts, we had to wait till the third paragraph before Chris Waller’s name came up, which suggests he wasn’t the WSJ’s source. As CNN noted, ‘while Bowman and Waller are both Trump appointees, the Fed is an independent institution that doesn’t consider politics in its decisions”. No, of course not. Heaven forbid.

[Note the Green Line!]

Powell was having none of it and mounted a “robust defense” of delaying further rate normalization in his testimony to the House Financial Services Committee. Naturally, he suggested that the delay to further rate cuts was driven by concerns about the potential inflationary effects of tariffs, and were it not for the tariffs, the Fed would probably have continued cutting rates (it’s your own fault, Donald). Still, the Republican members of the Financial Services Committee were not mollified. Vance offered a wonderfully succinct exposition of their position.

Those of us from the UK couldn’t help but be reminded of Henry VIII’s beef with Thomas Becket, another uncooperative high priest who got in the way of the King’s preferred policy. We doubt Powell will pay as high a price as Becket, but then we also doubt he will subsequently be beatified. Still, you never know. Is the new Pope a Democrat?

P.S. Brad Setser often puts out very interesting commentaries. We thought his “Ten Key Takeaways From Treasury’s Foreign Exchange Report” was definitely worth a read.

Stay Ahead with MacroCapture

If you're following the market impact of Powell, Trump, or tariffs, and want research that looks beyond the headlines, MacroCapture is for you. It’s clear, independent macro analysis—built for individual investors.

Sorry - Magna Carta was signed in 1215!

One small correction that does fit with the narrative! The King that called for the turbulent priest to be removed was Henry II and not Henry VIII. Henry II was a very reformist king and the first of the Plantagenets who sought to reset the relationship between crown and the barons, and provided the basis for the common law we use today. Thomas Beckett was his Chancellor, or most senior minister, who he made Archbishop of Canterbury to help reshape the church away from Rome, and to help to reshape the judiciary away from the Church and more towards law based courts. Beckett, however, started to defend the churches interests against the king’s plans. Henry said he didn’t mean for his knights to kill Thomas, but in his grand and significant vision for revealing England this was a problem. The parallels are clear to today. The Federal Reserve is independent in its decision making powers under the rules set by congress, although there is no congressional mandate for a 2pct inflation target! But whoever is the chair of the Fed is mandated under oath to act according to congress’s wishes and not the presidents. As a final note on the history, Henry’s son King John pushed royal authority too far, which of course led to the signing of Magna Carta in 2015.