Thoughts From The Divide – The Return to “Normal”

“A semblance of normality could take years”

Like labor tightness, inflation is now squarely in the known knowns and the question has shifted to wondering when price pressures and supply shortages will end. The ISM’s latest data, which covers June, says “not yet”. The ISM Prices Index hit the “highest level since July 1979” and ISM’s Tim Fiore summarized the situation as “virtually all basic and intermediate manufacturing materials are experiencing price increases as a result of product scarcity and the dynamics of supply and demand”. Other indicators we’ve been following continue to support the idea of more of the same. While chip shortages persist, there’s hope that things “will gradually ease over the back half of the year”. Bosch is set to begin production of automotive chips in September at a new fab in Germany, and Taiwan’s drought is no longer threatening chip production. However, the outlook for shipping, which we had been following here and here, is slightly less rosy. As this Bloomberg article notes, in the shipping industry, “when things go wrong, they go seriously wrong”. In addition to coronavirus outbreaks that continue to dog ports, “containers aren’t in the right places”. And even “once the world’s boxes are where they need to be”, the lack of investment in the industry, combined with record trade volumes, mean “returning to a semblance of normality could take years”.

“Truly Extraordinary”

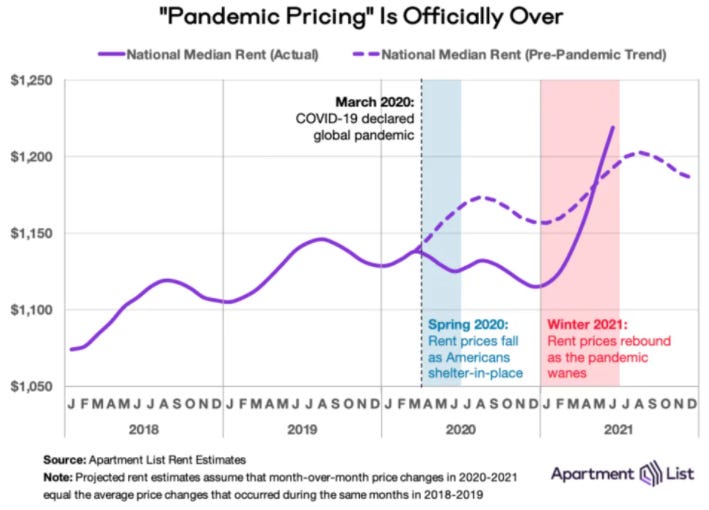

In the housing market, it appears that while some things have returned to normal, others remain rather “extraordinary”. On the normal front, apartment rental markets appear to have returned to their pre-COVID price trends. As Apartment List shows in a recent article, while there are significant local effects, having fallen after the Spring of 2020, rent prices have “caught back up with expectations” and the national median rent is now back above projections based on pre-pandemic dynamics. Meanwhile, things have not quite settled back to normal (whatever that is) for housing prices. The latest CoreLogic Case-Shiller Home Price report shows significant increases, including multiple large metro areas that “were up more than 20% from the year before” and the largest gain in the National Composite in more than 30 years of data. Admittedly, the report is somewhat backward looking and reflects data from April. But as far as the outlook goes, CoreLogic’s deputy chief economist believes prices “are likely to remain at double-digit increases through the third quarter of 2021”.