Thoughts From The Divide – The Energy Bell and Housing Ripples

“Even a moderate reduction isn’t ideal”

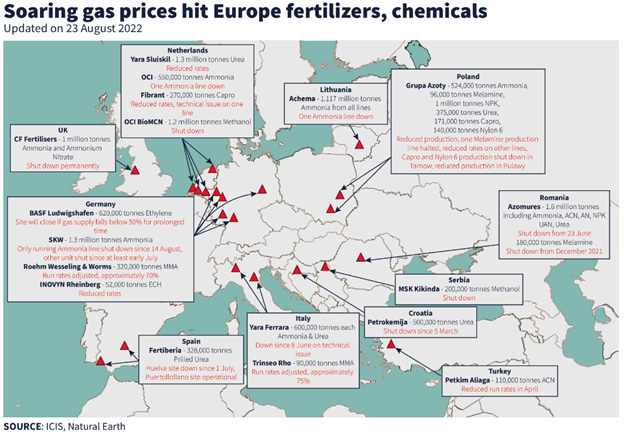

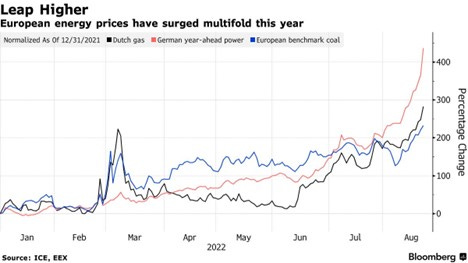

The last week has shown very clearly that one need never send to know for whom the global energy bell tolls; it tolls for thee (Constant chill deep inside?). Indeed, though much of the market commentary over the last few days is a touch of tunnel vision, with all eyes on Jerome Powell and Jackson Hole, the echoes of the ongoing global energy crunch continue reverberating. Companies in Europe are shuttering production of base chemicals and fertilizers, leading to warnings of shortages in intermediate goods.

Governments are looking to coal or nuclear to solve energy woes while other power plants are down for maintenance. And amidst it all, policymakers are searching for answers to rising costs, from proposing new relief measures to putting in price caps.

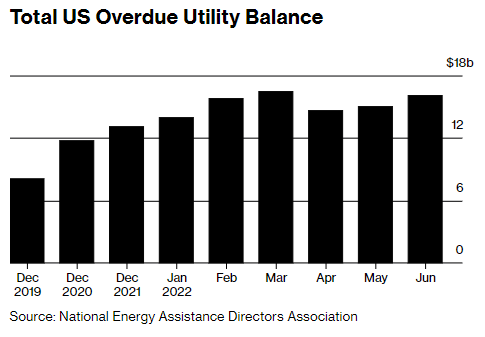

The US isn’t immune from energy market reverberations and aftershocks either. The latest information from the National Energy Assistance Directors Association was making the rounds this week as the group found that “20 million US households have fallen behind on their utility bills”. Diving in with some granularity, Bloomberg’s article on the subject explained that the figure amounts to “about 1 in 6 American homes”, with households owing “about $16 billion in late energy bills, double the pre-pandemic total”. “Underpinning those numbers is a blistering surge in electricity prices, propelled by the soaring cost of natural gas”. US gas price turbulence has also been amplified by the shifting timeline for the reopening of the Freeport LNG plant we’ve discussed before.

“Pricing to meet buyers where they are”

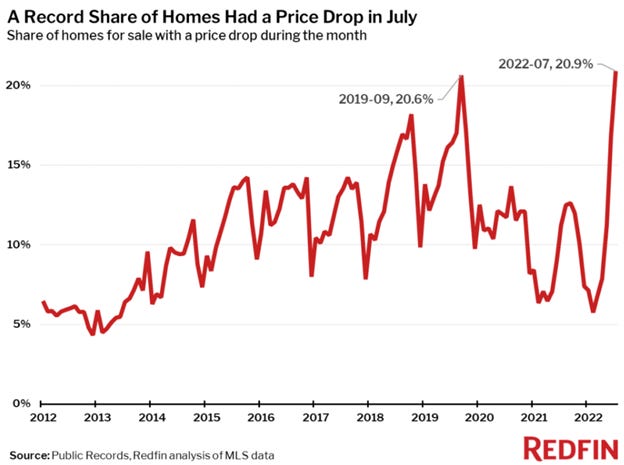

Problems in the housing market continue to ripple through the sector. As the graph below from Redfin shows, while mortgage rates aren’t on the meteoric path of a few months ago, the increasing price of housing has kept the “median mortgage payment” perky and up more than 38% YoY (To note for the data sticklers, this isn’t technically the median mortgage payment, but rather a hypothetical monthly payment based on current rates and the median price of a home).

This sticker shock is leading to a tapping of breaks. The significant decline in mortgage volumes (as evidenced by the MBA’s latest data) is starting to claim victims. As this article from Newsweek notes, in addition to some mortgage lenders who “have already laid off hundreds of employees” (see Wells Fargo last week), the pain in independent mortgage lenders is leading some to take more drastic measures, including declaring bankruptcy or closing permanently. In the meantime, while the aggregate data shows that the median home sale price is up 8% year-over-year, under the surface, Redfin’s data saw a record high in the share of homes with a price drop during the month of July.

P.S. Railroad worker negotiations are at loggerheads after a Biden board recommended 24% raises, but the rail unions said the recommendations didn’t “go far enough”.