Thoughts From The Divide: The Blame Game

While many love rollercoasters, the consensus in the office is that we have aged out, proving that you really can’t please all of the people all of the time. And so it was with “Liberation Day”. For market folk, the glass was clearly half-empty and investors seemed conflicted about their “liberation”: from close April 2nd to close April 8th, the S&P500 fell around 12%. Scott Bessent seemed nonplussed, repeating some stats about the distribution of stock ownership among Americans (hint: 50% of people don’t have any). It turns out the Tree of Liberty doesn’t only need periodic infusions of the blood of patriots and tyrants: it also swallows 401k gains. However, while equities had obvious reservations regarding Trump’s tariff policy, bonds seemed pretty relaxed about it all. Admittedly, the curve mostly bull-steepened, which does suggests some concerns about recession. But overall, things had seemed pretty happy in bond land, right up until Tuesday, when the 3-year year auction didn’t go as well as hoped. It turns out tariffs might have collateral effects on global capital flows.

It’s always darkest before the dawn, and things looked ominous for asset markets given anemic demand for bonds, increasing recession fears, and a chunky supply of duration. But in the end that just provided an excellent concession for buyers of the 10-year auction, which went well, as did Thursday’s 30-year auction. Older cynical people (moi?!) might wonder if the serious weakness in equities and the increasingly scary performance of the bond market might have had something to do with the President’s decision to roll back the reciprocal tariffs to a universal 10% on all but China (retaliation for their retaliation). A decision that some say was “foreshadowed” in a Truth Social Post earlier on Wednesday.

The decision prompted a 9.5% rally in stocks that took the S&P500 back to the level prevailing pre-Liberation Day. While kids may love roller coasters, those with medical conditions or those prone to motion sickness hate them. In much the same way, people (the same people?) with substantial equity portfolios, CEOs, and foreign trade partners might take quite a different view of Liberation Day and the ensuing shenanigans. Perhaps this explains Thursday’s market moves, where despite the good 30-year auction, the long-end closed below Wednesday’s open, and equities flirted with a halt? In the meantime, the EU announced an EV battery deal with the Chinese(!), and there are stories of force majeure being declared left, right and center. We hear that Howmet may not have been so exceptional. Even a cellphone has literally thousands of components, so supply disruptions anywhere mean higher working capital requirements. And we are sure you remember Powell and Co’s explanation for the inflation surrounding Covid. So, Trump’s attempt to cut the Gordian Knot with tariff policy is unlikely to be a quick fix, and the murk will get murkier, and the muddle more muddled, which to our simple minds suggests we should expect more collateral damage. Looking at the Apollo chart, it is clear we are not alone in expecting this.

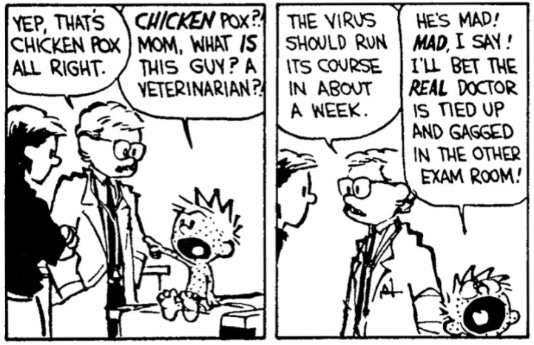

We mentioned that some investment bank economists were prepared to break ranks and risk their bonuses reputations by calling for recession. While the r-word is not used in polite company, recent market moves imply that it may be on more than one mind, and, like the Sword of Damocles, it hangs over both the “slow moving Fed” and POTUS himself. That said, outcomes matter less than you might think, particularly when it’s easier to get stocks to rally from a lower price. We’ll be interested to see how the tit-for-tat evolves between Trump and Powell’s Fed, because should the hammer/sword fall, the blame game will be played for more than just table stakes (sorry Apollo!). Think of it as a game of chicken where the main protagonists have ambiguous payout profiles, but YOU have a lot of skin in the game. So perhaps the right question is who will win in a game of chicken between Powell and Trump?

It’s hard to know who to trust in markets like this.

That’s why we created MacroCapture. No hype. Just analysis.

Was the goal of all this to get long rates down? I’m still confused

Julian, it is difficult to understand the extraordinary angst that the punditry is attributing to the masses whose only exposure to the stock market is through their 401Ks. if they have been investing in the Vanguard 500 fund via their 401k and have been doing so for 20 years, even after the "collapse" of the past several weeks, the index has moved from 1156 to 5363. that seems a pretty fair return. Even if only the past 10 years, from 2085 to 5363.

I sense that most of the pearl clutching is from the top 10%, and understandably, but most of them didn't vote for Trump to begin with.

The gravy train was destined to derail at some point. i have no idea how this will play out, and let's face it, nobody does, but it is hardly end of days here.

Perhaps the blame should be allocated to the series of Fed Chairs how financialized the entire economy