Thoughts From The Divide – Spills

“Companies defend their margins and workers push for higher wages, and prices keep rising”

While policymakers try their best to stay on message and control the framing, they can accidentally spill the beans every so often. This week we have a couple of interesting cases of inadvertent frankness. The first was perhaps more embarrassing than informative, with Chair Powell getting duped by Russian pranksters into…. “politely answering basic questions about U.S. monetary policy and the economic outlook”. While some of the video contain statements on the high likelihood of a recession and continuing rate hikes (plural), it was, broadly speaking, a rehash. The more striking comments came from Huw Pill of the BoE, who made headlines for saying that Brits “need to accept that they’re worse off”. While the BoE economist was getting pilloried in the press for his seemingly insensitive statement, John Authers wrote in defense of Pill, noting, “there are dangers in speaking honestly, even in the rather bland economic terms that Pill did, if your words will then be refracted through media designed for much shorter-form discourse”. Authers noted that the comments were taken out of context and explained that the BoE’s Chief Economist was describing how “after a few external shocks, inflation becomes a collective action problem” where “ideally everyone would take a share of the hit, and then they can move on. Human nature isn’t like that, and as a result, economics isn’t like that”. Beyond simply pointing out that in the UK, “we’re all worse off”, Pill’s comments revolve around the dynamics underpinning the infamous and much-feared wage-price spiral, where workers fight for higher nominal wages to counter rising prices and companies, working to protect margins (or perhaps just because they can), in turn, raise prices to counter higher costs, including wages. (Another alternative margin defense mechanism being sneaky and subtle “shrinkflation”).

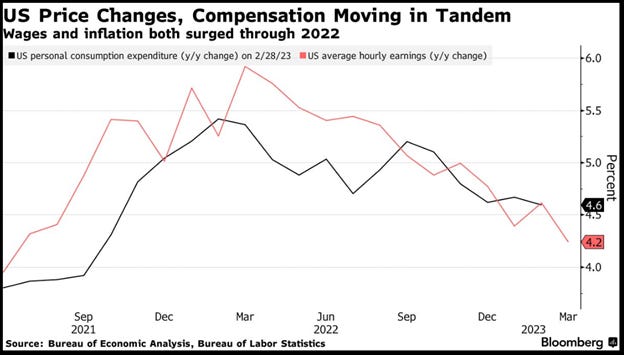

On that note, while we have highlighted Fed worries about a wage-price spiral, it appears that the issue may not be fully settled, with a recent Bloomberg article noting that some Fed officials are “skeptical wage gains will fuel further inflation” and that while Powell “has spoken of the risk of rapid pay gains feeding into prices”, other FOMC members “have played down their significance to the price outlook”.

“A tense phase that could damage local economies and cause financial hits to real estate investors”

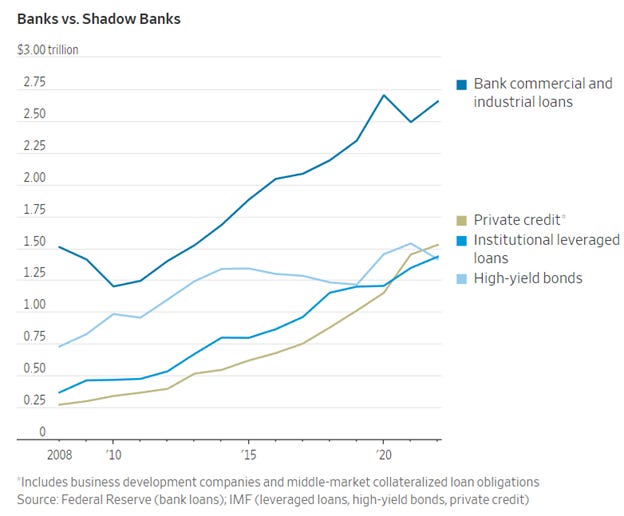

While there’s no sense crying over spilt milk, i.e., the ongoing dumpster fire in commercial real estate, the question is just how big the clean-up will be. Indeed, problems we have already discussed are once again making headlines. See, for instance, the latest news that Blackstone may be “in danger of defaulting on a $270 million loan backed by 11 apartment buildings in Ney York’s most expensive borough” despite “soaring” rents. Vornado added to this theme with the announcement that it would be suspending its dividend, though still doing share buybacks “in order to enhance shareholder value”. But it remains to be seen how far the gangrene has/will spread. As a potential indication of the depth/breadth of the rot, a San Francisco property valued “around $300 million in 2019” is for sale and bids “are expected to come in at about $60 million”. All of this reflects the stress building in commercial real estate, where “lenders are increasingly reluctant to make new loans to owners of office buildings”. On a related note, while much of the focus has been on the problem of bad debt compounding the already sickly condition of bank balance sheets, they are just the “tip of the iceberg”. Though “banks are the most visible debtholders”, “collectively, just as much debt is held by pension and mutual funds, private-credit funds, life insurers, business-development companies, hedge funds, and other nonbanks—or, as they are sometimes called, shadow banks”.

“The freight cycle may be at a bottom, just because conditions are so bad for smaller fleets”

Another place drowning in spilt milk is transportation, an area we touched on last week. Following JB Hunt’s disappointing earnings, CH Robinson’s latest numbers “were a sea of down arrows, as had been expected”, with the results reflecting “the softening market conditions that have transpired in the freight transportation market over the past 12 months” where, “the balance of supply and demand has shifted from a tight market a year ago to one that is now oversupplied”, which seems a pretty succinct way to explain profits declining more than 20% YoY. The silver lining is that volume was down only 3.5%, and there’s hope “the freight cycle may be at a bottom”. Also following on from last week’s “rubber meets the road” discussion, FreightWaves also highlighted recent data from one of North America’s largest containerboard producers, whose “shipments were down nearly 13%, a decline as severe as during the depths of the Great Financial Crisis”, though we’d point out that the base effects that are part of these numbers aren’t quite comparable, given that the pre-GFC period didn’t have the upside benefit of Covid lockdowns and stimulus checks driving e-commerce.