Thoughts From The Divide – Ruffling Feathers

“Grin and bear it”

Considering the grilling Powell got last week for “the difficulties that inflation poses for individuals… especially those with limited means”, he should consider himself lucky that the press conference wasn’t after this weeks’ PPI and CPI releases. Both measures hit multi-decade highs, with Headline CPI’s 6.2% reading making it the highest since the early 1990s, while PPI for Finished Goods hit 12.5%, the highest reading since the early 1980s. Yikes!

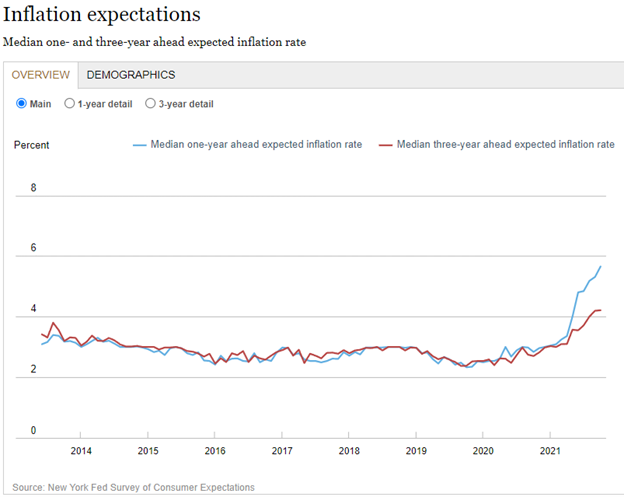

What’s more, this week, just as PPI and CPI delivered those whopping prints, consumers are making it clear that they continue to lose confidence, as shown in the latest University of Michigan Survey of Consumers. In addition to buying conditions for houses, durables, and vehicles all plumbing the lowest levels since at least the 1980s, consumers continue to expect higher inflation, with year-ahead inflation expectations hitting 4.9%. This sentiment is echoed by the New York Fed’s consumer inflation expectations (here’s looking at you, Larry), with one-year inflation expectations reaching 5.7%, a new series high, and three-year inflation expectations tying last month’s reading at 4.2%.

But the rubber really hits the road in the Michigan survey’s look at consumers’ expectations for real incomes. Despite recent wage gains, expectations for higher inflation dominate sentiment, with half of families anticipating reduced real incomes next year and Real Income Expectations During the Next 1-2 Years continuing to swan dive. Regarding the souring mood, the survey’s chief economist wrote that it was partly due to “the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation”. Perhaps even more disconcerting to both Powell and policymakers was Michigan’s finding that “one-in-four consumers cited inflationary reductions in their living standards in November, with lower-income and older consumers voicing the greatest impact”.

However, if that weren’t enough, it appears that consumers’ feathers may be ruffled even further going into Thanksgiving (see here on what happens when the American consumer’s holiday is upset). While the latest CPI food at home numbers came in at 5.4%, the index hides some pain points. Front and center is, of course, the all-important turkey, where prices, according to a recent article, are up 25% “in just the past year”. But other holiday favorites will also cost more, with recipe staples up double digits year on year, including eggs, which are “up nearly 30% in a year”, and sugar, which has seen a 12% increase in price over the same period.