Perhaps we are atypical, but we found the Jackson Hole Economic Symposium to be a mix of compelling drama and “The Office-style” comedy. The fun started with reports that Yellowstone security was beefed up when a MAGA enthusiast confronted Governor Cook in a threatening manner. It turns out that it was just James Fishback doing his best to make friends in high places, but regardless, the press coverage gave a palpable sense of tension at Jackson Hole. This was reinforced when Christine Lagarde led the auditorium in expressing their support for Chair Powell with a spontaneous standing ovation before his speech.

The prevailing narrative is that an authoritarian dictator is attempting to end the independence of a Central Bank, by hook or by crook, forcing officials to show “true grit” in resisting this completely unwarranted and unprecedented Presidential interference. Sadly, we couldn’t find any video of the applause (Jackson Hole is a private event), so please consider this symbolic of the heart-warming display of global central banker solidarity. Central bank policymakers have a unique understanding of the stakes involved: one of their own is under attack, as is the inviolable principle of Central Bank independence. It was clarifying to Google all the instances where the situation was described as an “unprecedented attack on the independence of the Fed”. It’s not that we disagree that this is an attack on Fed independence. It’s the use of “unprecedented” that we have a problem with.

The Federal Reserve Act of 1913, which created the Fed, included provisions that tied it closely to government: the UST Sec. and the Comptroller of the Currency were originally ex officio members of the Federal Reserve Board. The Treasury-Fed Accord of 1951 marked the first point at which the Fed could be described as independent in setting monetary policy. However, that didn’t stop Presidents from using the tools at their disposal to shape either the staff or the actions those staff members would take. McChesney Martin once said that “The Federal Reserve is independent within the government, not independent of the government”, which would have gone down like a plate of “Prairie Oysters” at the Symposium. It was particularly amusing to watch Lael Brainard discuss the “unprecedented threat to Fed independence”, given she was a) appointed FOMC Vice-Chair by the Biden Administration, b) relentlessly dovish during her term, and c) subsequently moved straight from the Fed to the Biden Administration as its NEC head. Brainard was Team Biden’s Fed representation, and she did a great job in delivering the Biden Administration’s preferred monetary policy. Partisan rate cuts for me but not thee? It’s also amusing (well, to us) to watch unelected global central bankers convinced of their right to conduct policy “independently” when their recent (and not so recent) record on inflation is so poor.

Still, none of this makes any of them wrong, nor Trump right. More to the point, MI2 doesn’t deal with questions of morality. Ours is not to reason why; ours is to make money from macro. The key macro question here is whether Cook can hold on beyond February. February is critical because that’s when the Fed Board will decide which regional Fed Presidents are reappointed. If Cook is replaced, Trump will be able to pick new regional Fed Presidents, ensuring an instant FOMC majority. So, the question and timing of Cook’s eventual fate are key. Cook appears up for a fight, and while last week we didn’t fancy her chances, perhaps we misunderstood the ask. All she needs to do to thwart Trump may be to hold on past February, and she could well do that, particularly if some “anonymous well-wishers” were prepared to pick up her legal costs. It’s worth noting that Cook is not assuming that the Board of Governors has her back. Adam Levitin (unsurprisingly) makes a strong argument on this. Trump appears to be trying to bluff to get his way, as a DOJ prosecution is neither a sure win nor likely to meet his February deadline. However, others argue that Trump is not going to “go gently into that good night”, and it’s hard to disagree with that assessment. Trump will keep looking for a solution, and he has a lot of levers to pull. Advice to members of the FOMC? Now is not the time to risk parking illegally.

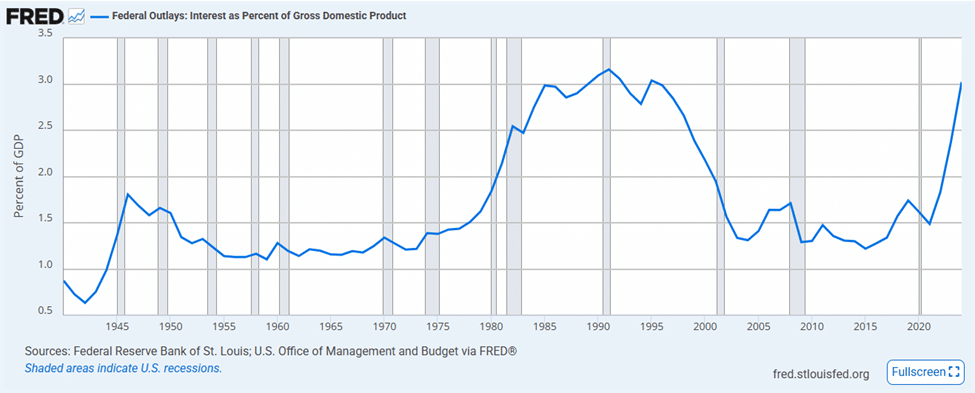

Why should any of us care about this fight? Well, for one, if you ask yourself what the birth pangs of fiscal dominance look like, well, they might look a bit like this. The idea that the problem is simply that Trump is uniquely bad seems superficial. Trump’s motive for interfering with monetary policy is rooted in the fiscal implications of costly debt service. Ultimately, this fight will impact the relative attractiveness of equities vs longer bonds, over the short to medium term and the relative attractiveness of the dollar.

From the fate of Fed leadership to the global implications for bonds, equities, and the dollar, MacroCapture by MI2 Partners gives investors the actionable edge to trade the macro theater—not just watch it unfold.

the thing I find more remarkable is that she was put on the board as a reliable dove to vote to keep rates low for Biden and now she has suddenly decided that low rates and inflation are bad simply because she is concerned it could help Trump