Thoughts From The Divide – Inflation and Fed Hawkishness

“We’re not near done yet”

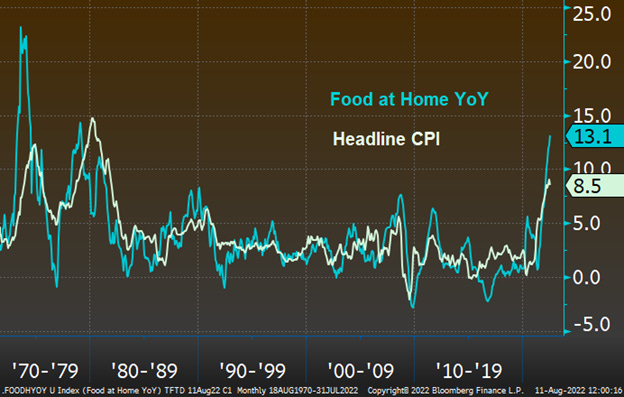

This week’s CPI numbers were a mixed bag. As news stories highlighted some of the more extreme readings, with many focused on the rocket-like rise in food at home and specific grocery items, both Core and Headline came in below expectations, and Headline’s month-on-month reading of 0.0% had some commentators (including the Biden Administration) making celebratory comments (perhaps too soon?).

However, whether this proves to be the peak, the Fed isn’t so sure (perhaps because their own measures show “inflationary pressures remain broad-based”). Following last week’s attempt to quash talk of a pivot, Fed speakers were back at it again, trying to convince markets that it remains serious about bringing down inflation. Former super-dove Kashkari appears to have changed teams and took a hawkish tack at an Aspen Institute event, saying that the Fed is “far, far away from declaring victory” and reiterating that while this week’s inflation numbers were “a hint that maybe inflation is starting to move in the right direction”, but they “don’t change my path”. The Fed president also confirmed that he “hasn’t seen anything that changes” his recommendation of Fed Funds “being at 3.9% by the end of this year, and 4.4% by the end of the following year”. Echoing Kashkari’s statement, Daly said that while “there’s good news on the month-to-month data”, “inflation remains far too high and not near our price stability goal” and continuing strength in core prices means Daly doesn’t “want to declare victory on inflation coming down”.

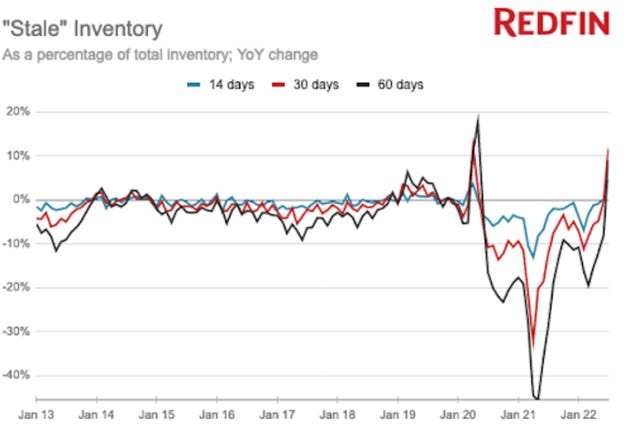

P.S. The housing market continues to deteriorate in the background, with Redfin’s latest research noting an increasing share of “stale” listings.

P.P.S. Energy and water problems are continuing to pop up (and are sometimes feeding each other!) in France, South Africa, Sri Lanka, and Germany.