Thoughts From The Divide: Hazardous

“If the economy sinks into a recession as many expect, owners will be whipsawed again”

The Fed’s SLOOS lending report, now with the post-SVB reaction baked in, has attained a new significance with recent events. While tightening credit standards was no surprise, the weakening in credit demand was somewhat ominous. This relatively gloomy credit outlook was corroborated by the latest NFIB survey, where a “net 6 percent reported their last loan was harder to get than in previous attempts”. However, the April reading was a slight improvement over the March report.

Similarly, given the circumstances, the FDIC proposal of a “special assessment” (HOA members may shudder) to “recover losses associated with the uninsured depositors” isn’t a surprise. But it certainly isn’t comforting for the banking sector. The FDIC has suggested that banks with more than $5 billion in assets should contribute, though the 113 banks “with total assets over $50 billion” will bear the brunt of the cost.

“The economy, particularly the job market, has always played a significant role in housing demand”

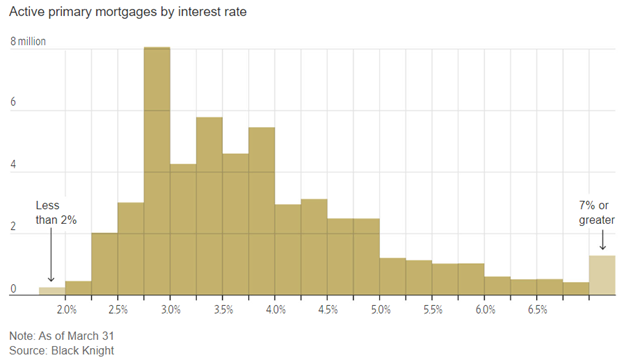

As this article from the WSJ reminds us, higher rates may have a push-pull effect on housing. Mortgage applications remain less than half of what they were at the 2020 peak, as owners with locked-in rates below current prevailing rates are unsurprisingly opting to stay in their current homes and keep their low mortgages. This is “keeping the supply of homes for sale unusually low and making the market more competitive and more expensive than forecasters expected.” John Burns RE Consulting analysis went one step further than most, explaining that “would-be sellers” choosing to “stay in place as they are locked into below-market mortgage rates” has been helpful to home builders, but that long term, “we expect a correction close to the 30.6% norm [in relation to incomes and housing costs] sometime in the future through a combination of rising incomes, falling home prices, and falling mortgage rates”. How the return to the norm is distributed among those factors will likely tell us who among homeowners, lenders, and debt holders will come out of the situation with a smile. A cynic might wonder, can everyone lose?

The BoE’s Andrew Bailey continued along the narrative trail blazed by Chief Economist Huw Pill a few weeks ago regarding the state of the UK economy. The BoE Governor said that while he didn’t “think Huw’s choice of words was the right one”, he agreed with the thesis, saying that “What I’m afraid we can’t duck is this very big hit to national income, which we have to deal with”. Exactly who takes the hit is likely going to be the ongoing debate and just such a fight is on in Germany, where a proposed subsidy for industrial power is facing pushback.