Thoughts From The Divide: Friction

“Being… set up for it is one thing, having it is another”

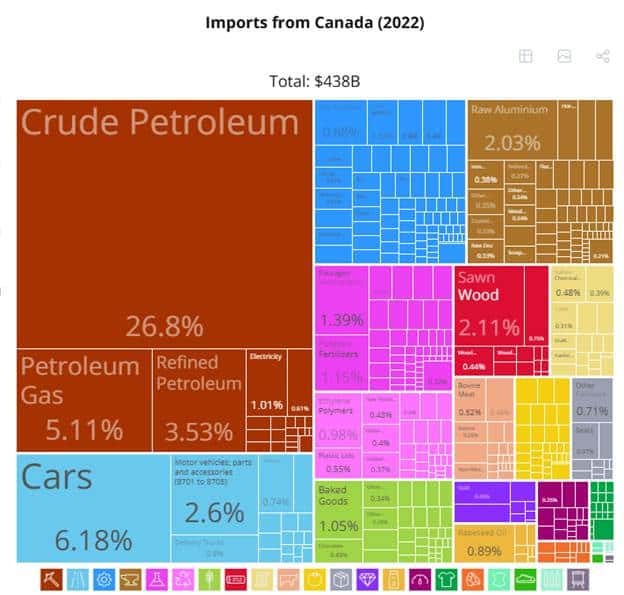

If you’re wondering what the crashing sound is in the background, it’s the bull in the China shop discussed last week as the Trump Administration works up a full head of steam. Will it go through with 25% tariffs on the US’s neighbors? Is there going to be a giant sucking sound in some parts of the economy courtesy of a potential funding freeze on federal grants and loans? Will there be a squeeze in citrus prices due to missing workers in California? The age-old shoulder shrug of “time will tell” certainly applies, but some people aren’t taking the uncertainty sitting down: Companies are rushing imports and/or starting a “tariff taskforce” to work through potential issues. Canada’s central bank warned that with the single tool of the policy interest rate, it “can’t lean against weaker output and higher inflation at the same time”, and the Canadian federal government appears to be “planning a stimulus package to help businesses and Canadians” if Trump goes through with the threat of tariffs.

Mme. Lagarde also warned of potential fallout, saying “Greater friction in global trade could weigh on euro area growth by dampening exports and weakening the global economy”. Indeed, that would seem to be the point, madame.

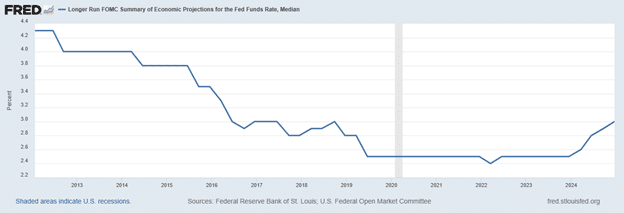

However, all of the policy kerfuffle aside, at least we have the consistency of Fed meetings for a sense of normalcy? This week, Powell and crew held interest rates steady, with their current policy being “not highly restrictive, but meaningfully restrictive”, the labor market “pretty stable and broadly in balance” and inflation on its merry way back down, seemingly “set up for further progress”. These did, in classic Jerry fashion, come with a caveat or two. Policy may be restrictive, but, those darned works, “Overall financial conditions are probably still accommodative”. Employment? “If you have a job it’s all good” but it is a “low hiring environment” (sounds like a euphemism, good sir) and they “don’t think we need it to cool off anymore”. And inflation? Thankfully, OER and housing services are “coming down pretty steadily now”, but Powell did mention that the range of possibilities is “very, very wide”. “We’re just going to have to wait and see”.

Which might seem to validate all those CEOs taking steps to duck and cover.

With a focus on market signals and policy shifts, MI2 Partners equips investors and businesses with the insights needed to mitigate downside risks and seize emerging opportunities.