Thoughts From The Divide - Free Lunch?

“The economy is defying predictions that inflation would not fall absent significant job destruction”

Over the last few weeks, we’ve followed the various policymakers’ warnings that “the beatings will continue until morale improves” or, more literally, until inflation returns to its pre-Covid ranges. This week, we were struck by the kinder, gentler message of ex-Fed Veep Lael Brainard in her most recent speech. With both PPI and CPI data at the lowest levels in at least a year, and lower than already reduced expectations, the former FOMC member seemed to argue that, there may be such a thing as a free lunch after all. In addition to noting that “despite repeated forecasts that recession is just around the corner, the U.S. recovery is solid, and inflation is down”, she thumbed her nose at the idea that bringing down the rate of price growth would require some pain on the part of the American worker: “The economy is defying predictions that inflation would not fall absent significant job destruction”. She cited “new and encouraging evidence that the U.S. economy is on the path to moderate inflation accompanied by a resilient jobs market”. What’s more, she noted that “Real wages are now higher than they were before the pandemic, and this is particularly true for production and non-supervisory workers who make up roughly 80 percent of the workforce”. So not only has inflation been vanquished, but it appears to have been without significant labor market costs. This optimism didn’t prevent her from taking a moment to admonish corporations in the now ubiquitous manner, “It will be important for corporations to continue to bring their markups back down after having raised them to unusually elevated levels over the past 2 years, which would help in reducing inflation. The markups associated with price-price spirals- with final goods prices going up by more than input prices – should unwind if customers become more price-sensitive and firms compete more intensely for customers”. (As a reminder, those increased markups have helped paper over declining volumes, see Pepsi’s latest results). Probably a good thing: many of us could do with losing a few pounds. But we can’t help but think Dr. Brainard’s speech should be considered the first speech of the coming Presidential election campaign.

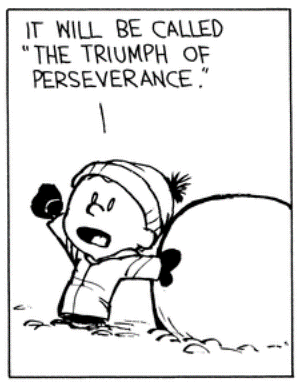

Larry Summers took the other side of the argument ahead of the CPI release, arguing the case for additional beatings. In a tweet linking to a Bloomberg interview, Dr. Summers suggested that the Fed is “gonna be surprised by what they have to do to interest rates”. In the interview itself, Summers cited a wide array of employment data that was “pointing to inflation way above the Fed’s target” and warned against taking victory laps: “the fact that the rate [of inflation] has come down shouldn’t be confused with saying that we can be confident that we’re on a path of this all being okay” and had a warning for those trumpeting the latest numbers, “… nor should anybody take comfort from the fact that the components of inflation that everybody recognized were transitory” have come down or even reversed. Summers concluded, “soft landings represent the triumph of hope over experience”.

Who doesn’t like hope?

P.S. RIP Anchor Steam?