Thoughts From The Divide – Emergency Measures and Delinquencies

”About to Exhaust Their Funding”

Just as California is reinstituting business closures, Goldman Sachs is exploring “the need for additional loan funding” for small businesses. As covered in Axios’s article, “PPP was not enough for small businesses”, the Goldman survey found that 84% of PPP recipients will run through their funding by the first week of August, with only 16% saying they are very confident in maintaining their payroll. Instead, there is a worry that, barring an additional injection of support, small businesses “may start laying off employees”.

An NFIB survey, also referenced by Axios, echoed Goldman’s findings. Survey respondents were cautious, with 22% anticipating having to lay off employees after using their PPP loan, “finding that economic conditions are unable to support current staffing levels”. On the bright side, “economic conditions have improved for many small business owners”, and “conditions are still challenging for most but less so than about two months ago”. However, doubt remains, with the likes of even Jamie Dimon and the Fed’s Lael Brainard seeing a “murkier” economic outlook and a “dense fog of COVID-related uncertainty shrouding the outlook”. (Brainard covered a number of topics in her speech, including some hints at YCC, as explained in the latest Fed Watch from Tim Duy.)

“Ongoing tussle”

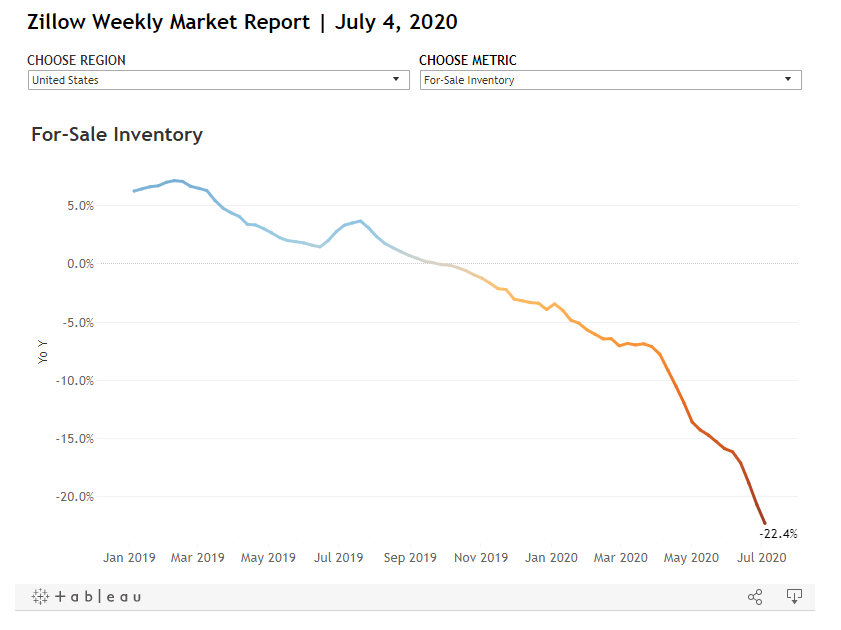

A couple of weeks ago, we looked at some of the turbulence in Commercial Real Estate, with anecdotal evidence, such as the Brookfield/Gap spat, and more recently, Thor vs The Wing, now piling up. However, Residential Real Estate hasn’t skated by unscathed. As explained in an article from the Washington Post, new delinquencies are hitting record levels. While the data “come wrapped in caveats”, CoreLogic’s data paints a gloomy picture and warns that if “delinquencies continue to follow the virus”, serious delinquencies “will quadruple over the next 18 to 24 months, meaning that about 3 million borrowers could be at risk of losing their homes”. This could lead to compounding stress down the road, but “the housing market looks strong for now”, with Zillow reporting that “homes are flying off the market at a record pace and inventory remains incredibly scarce”.