Thoughts From The Divide: Don’t Blame Me

“Like most forecasters, we expect growth to moderate… Of course, that remains to be seen”

The classic follow-up to this week’s title is “I voted for McGovern” and was the self-righteous button-expressed response to the unravelling of the Nixon presidency by those who favored his opponents. It came to mind because we had recently noticed both policymakers and pundits have taken pains to emphasize the difficulties of forecasting in the current uncertain environment. Some might uncharitably confuse these observations as an attempt to avoid responsibility or pass the buck. This seems unkind, although it did bring to mind the ongoing research into the ability of some critters to detect earthquakes in advance. To our knowledge, there is no hard evidence that policymakers share this ability.

Jerome Powell’s past comments suggest he sympathizes with this point of view, having previously described forecasters as “a humble lot with much to be humble about”. This week, Chair Powell opted to emphasize the FOMC’s humility in his speech to the IMF, pointing out that “like most forecasters, we expect growth to moderate in coming quarters” but following that up with “of course, that remains to be seen”. He was only slightly less hedged in his comments on the restrictiveness of monetary policy, saying that while “monetary policy is in restrictive territory and putting downward pressure on demand and inflation”, “we are not confident that we have achieved… a stance” that is “sufficiently restrictive to bring inflation down to 2 percent over time”. Also, don’t blame him for needing to hit demand: “Supply shocks that have a persistent effect on potential output could call for restrictive policy to better align aggregate demand with the suppressed level of aggregate supply”. A good reminder for the losers that it’s not personal, it’s just “realigning aggregate demand”. Oh, and in case anyone was wondering… “While the broader supply recovery continues, it is not clear how much more will be achieved by additional supply-side improvements. Going forward, it may be that a greater share of the progress in reducing inflation will have to come from tight monetary policy restraining the growth of aggregate demand.” As the saying goes, beatings will continue until morale improves, but we assure you, it is out of love. Cue the “below trend growth” euphemism stream.

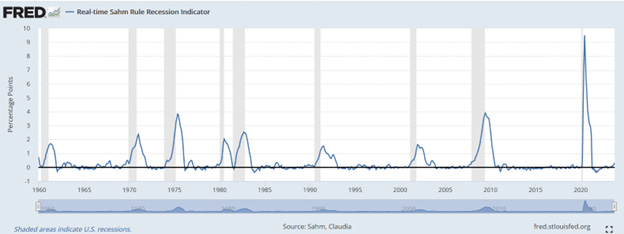

Another (former) Fed officer who is keen to adjust the public record is Claudia Sahm, whose rule we have mentioned before. Sahm gave a series of interviews and writings last week, including pieces in the FT, Bloomberg, and in her own blog to make several points. First, the recession trigger/signal/rule has yet to be triggered. Second… “it’s not a forecast, it’s an empirical regularity”. Yes, indeed, Claudia, we won’t blame you. Your rule yields its first-ever false positive; it triggers, and we don’t have a recession. She did observe (confirming some of what we have said in the past) that “once the labour market starts to slip, if you’re looking at the unemployment rate, it keeps going”. We concur. And what’s more, this means that the Fed’s outlook on the SEPs is ridiculous, or as Sahm put it, “if you look at the forecasts that Federal Reserve officials have been writing down for quite some time now, essentially they have the Sahm Rule being triggered but no recession: the unemployment rate rises above 4 per cent, and then it goes sideways. You can tell a story right now as to what keeps it in bounds, but we’ve never seen it. The impossible is possible, though and that’s been the theme of this year”.

P.S. Forecasting gets even harder when the numbers keep changing on you! This note from the SF Fed blog explains that thanks to “a comprehensive data revision”, “a larger fraction of aggregate excess savings remains in the economy than previously expected”, and “these excess savings are likely to continue being drawn down into the first half of 2024.” Hooray!

Yahoo Finance Feat. Julian Brigden - November 3rd

“Fed needs to continue to ‘grind this thing out'” - The October jobs report revealed slower payroll growth and slightly higher unemployment, which Julian says still points to recession risks. He believes a downturn is hard to avoid given the mix of high inflation and a strong labor market. While nominal GDP remains resilient for now, Julian says if there is a scenario where there is low inflation along with steady nominal GDP, it would accel “real growth,” risking renewed wage and inflationary pressures.

Real Vision: Global Macro Feat. Harry Melandri & Alex Gurevich - November 6

“Is a Real Rates Tsunami Upcoming?” – Harry Melandri from MI2 Partners and Alex Gurevich, founder and CIO of HonTe Investments, discuss the resurgence of higher real rates amid the Fed’s quantitative tightening and prolonged higher interest rates. Gurevich shares his 2024 inflation and growth outlook and offers insights on how to craft a balanced portfolio during these uncertain times.