Thoughts From The Divide – Calvinball

While it may give comfort to think markets, politics, etc… are orderly, the current crises have made it clear that in many ways, reality is more like Calvinball. For those not familiar with it, Calvinball is from Bill Waterson’s comic strip Calvin and Hobbes, where the titular characters play a game in which “the only permanent rule is you can’t play it the same way twice”. Indeed, over the last few weeks, the rules of the game around the world appear to be in flux.

“The Fundamental Question”

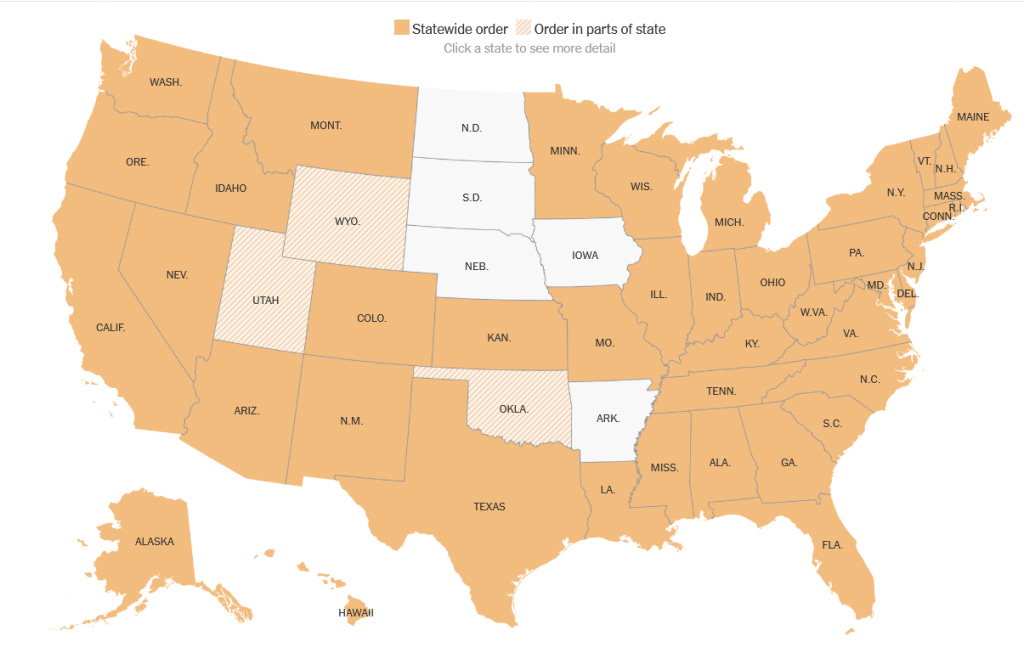

Amid pushback in states across the U.S. local governments are reconsidering their CV19 guidelines keeping people home, including our own Colorado. This could be a welcome reprieve for small businesses that have been in lockdown or severely limited in their operations. But these guidelines will likely remain fluid as the world’s understanding of CV19 evolves. As Melanie Mason of the LA Times reports, there are several recent studies indicating the spread of coronavirus has far outpaced “the number of officially confirmed cases”. The article cites a research paper from Stanford University that concluded “the infection is much more widespread than indicated by the number of confirmed cases”. At this point, that conclusion could be interpreted from either a glass-half full or a glass half-empty perspective, depending on whether reinfection is possible, but combined with data coming from jails and Iceland (an unlikely combination to say the least) on asymptomatic infections, it is clear that the characteristics of CV19 aren’t yet fully known and policy whipsaws are likely to continue.

“Made Repeated Changes… to Stave Off Collapse”

Beyond the fluidity around CV19, many facets of the economy are working on establishing new rules and “new normal”s. Case in point, despite what some might view to be a mathematical impossibility, May oil contracts traded in the negative yesterday as markets grappled with oversupply and storage problems. USO, an oil ETF at the heart of the wild dynamics, today changed its rules, issuing a statement advising that “in response to ongoing extraordinary market conditions” it would invest in contracts “in any month available or in varying percentages”.

Changing Rules

Beyond oil markets, the FHFA is changing its rules for mortgage servicers, NATO is calling for a review of rules regarding Chinese purchases of critical infrastructure and businesses, George Soros is calling for the EU to issue perpetual bonds, Argentina is asking to restructure some of its debt, and even the common knowledge that airlines are trying to squeeze as many people as possible into planes may be tested. Perhaps Calvin was right in saying “Sooner or later, all our games turn into Calvinball”.