Thoughts From The Divide – Back to the Basics

“While this is substantial, it is far from unprecedented”

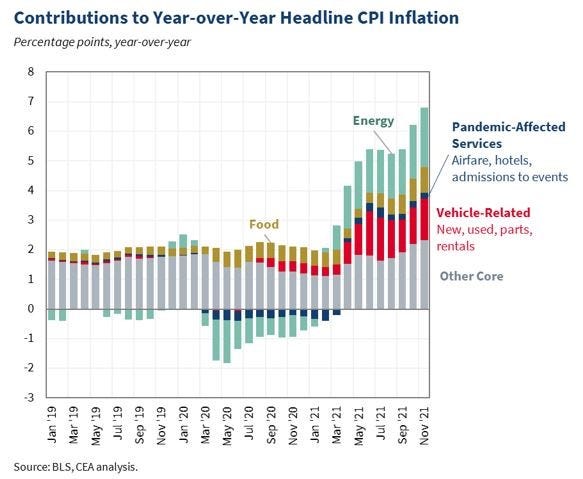

It’s once again the time of the month where markets and policymakers digest the latest CPI readings. That both Core and Headline CPI came in today roughly in line with expectations (at 4.9% and 6.8%, respectively) is likely some relief to both Fed officials and politicians alike. However, with the former currently in the middle of their premeeting blackout period (the retiring of “transitory” proving to have been a good play, at least so far), it was left to the latter to give us the official party line. In that sense, the Whitehouse Council of Economic Advisers, whose work on OER we’ve highlighted before, delivered. In a Twitter thread, the CEA walked through the details of the latest data, highlighting that roughly half of the growth in headline inflation was due to rises in car and energy prices, with food adding a little less than one percent.

Given how much they’ve moved the needle, it’s worth diving into the latest data on these highflyers.

According to the Manheim Used Vehicle Value Index, used cars continue to make all-time highs. The Index, which adjusts for mix and mileage, is up a whopping 43.5% on a year over year basis, and it appears that nosebleed prices are wearing on consumers. As the report from Mannheim notes, volumes are down double digits YoY in both commercial and retail sales, and Manheim cited the Conference Board’s Consumer Confidence survey, noting that “Plans to purchase a vehicle in the next six months declined to the lowest level since 2010”.

Though gasoline and natural gas prices have dropped recently, as highlighted in the Whitehouse’s statement on inflation earlier today, it’s perhaps a little early to declare mission accomplished across the board on energy. As an article from the WSJ discusses, even before a new “fee” on methane usage, the EIA is predicting that many households who “primarily heat with natural gas will pay 30% more this winter than they did a year ago—50% more if this winter is cold”. And even if demand lightens up in the US, Europe’s ongoing energy woes may help keep domestic prices elevated.

Finally, food prices are also on course to keep moving upward. General Mills and others have already announced planned price increases for 2022. Meat prices continue to surge, with double-digit gains YoY despite political attempts at reining things in. And input costs aren’t letting up, with the fertilizer shortage leading some farmers “scrambling for animal compost”.