Thoughts From The Divide – A Nightmare on Wall Street

“Things are looking a little too good to be true, so it makes me think that something’s gotta give”

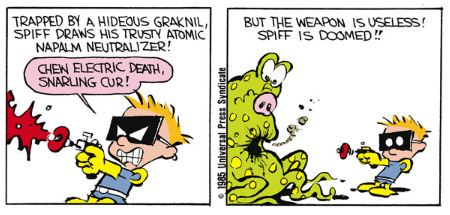

It’s the spooky season again, and with that in mind, let’s return to a common scene in many a horror movie:

A protagonist, frantically fleeing a monster of some form or another, racing from one place to another, failing to hide, failing to construct an effective barricade, finally stumbles upon some kind of weapon. Breathlessly steeling themselves, they turn to face their tormentor; they take a stand and… Bang (Slash/Splash/etc.…)! The monster takes a full dose of the medicine… and continues undaunted.

The idea of ineffectuality appears to have now seeped into the heads of Fed officials. What if the monetary policy bullets are not enough to slow the economy? This thinking was most clearly on display in Governor Waller’s latest speech. Like the family that moves into a neighborhood that seems just a little too perfect, Waller’s opening quote suggests he is unnerved by the apparently benign status quo and expects a hammer to fall. More granularly, Governor Waller outlines two scenarios. The first is that things go to plan, the inflation monster is vanquished, and “the real side of the economy slows” in line with the September SEP. This would allow the Fed to “hold the policy rate steady and let the economy evolve in the desired manner”. Pan the camera out, queue the upbeat music and roll the credits. The second scenario, which Waller “can’t avoid thinking about”, involves a potential boogeyman. What if… “demand and economic activity continue at their recent pace, possibly… stalling or even reversing progress toward 2 percent”? Then, quite simply, “more action would be needed”, and more specifically, “if the real economy continues showing underlying strength and inflation appears to stabilize or reaccelerate, more policy tightening is likely needed despite the recent run-up in longer-term rates“. (Emphasis our own.) Let’s call it the “the monster is impervious” scenario. Being of a cynical disposition, we can’t help but think the Governor was just warning us all not to get too aggressive in placing steepening bets.

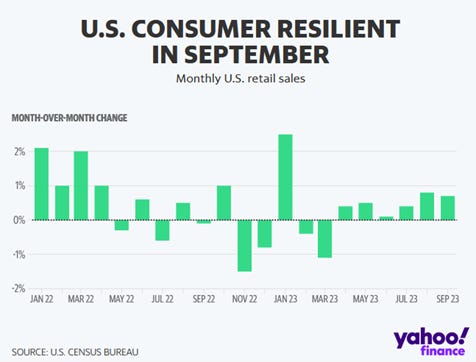

But the bad news for Waller (and potentially all US debtors) is that things do appear to be running along undaunted so far. Despite the recent headlines (and our own coverage) of the tenuous state of the US consumer, it appears that another horror trope, that of the zombie, may be applicable as the latest retail sales data “smashed expectations“. The “US consumer slowdown is nowhere in sight”. Factory orders also appear to be impervious as the manufacturing metric “continues to plod along despite 525bp in rate hikes from the Federal Reserve since March 2022”. Indeed, combining the latest GDPNow and Inflation Nowcast puts nominal GDP at a less than morbid level of > 8%! In the circumstances, it’s not so surprising that the bond market is getting hammered.

There is, however, some hope (hope dies last) that the monster may bleed out via employment. As Jerome Powell noted in his opening remarks before a Q&A at the Economic Club of New York, “indicators of wage growth show a gradual decline toward levels that would be consistent with 2 percent inflation over time”. This sentiment was seconded by the latest Beige Book, which noted that “Labor market tightness continued to ease across the nation”.

Let’s hope for their sake things are indeed easing. Otherwise, they may need to start looking for some silver bullets.

If you missed our Global Macro Summit, you can still dive into all the valuable content with our Post-Event Pass!

📚 Presentation Recordings: Revisit and dive deeper into the insightful sessions at your convenience.

📄 Presentation PDFs: Get your hands on all the presentation materials for future reference.

📝 Transcriptions: Read and analyze every word from the experts' discussions.

📊 MI2 Debrief Report: Gain a comprehensive overview of the key takeaways and insights written by the MI2 Research team.

Don't miss out on this opportunity to catch up on the invaluable knowledge shared at the Global Macro Summit. Secure your Post-Event Pass today and stay ahead in the world of macroeconomics!